Why? The simple answer is that construction details matter in achieving both lower trading costs and higher performance. Creating factor-replicated portfolios that match the factor loadings of these smart beta strategies is easy, but the factor-replicated portfolios are poor substitutes for their smart beta counterparts: performance is poor, turnover is high, and capacity is terrible. We test this assertion by replicating three first-generation smart beta strategies-Fundamental Index ™, equal weight, and minimum variance-with factor tilts. Some have suggested that certain smart beta strategies are essentially factor tilt strategies in disguise, which can be replicated with factor tilts applied to a cap-weighted market portfolio. Capitalization weighting does not do that-neither does a portfolio that applies factor tilts to a cap-weighted starting portfolio. Initially, the term “smart beta” referred to strategies that broke the link between the price of a stock and its weight in the portfolio or index.

In this article, we challenge the common view that smart beta strategies and factor tilts are equivalent. This may be contributing to many of the new live factor strategies faring as poorly as they are, even though the periods over which their performance is being measured are too short to draw any meaningful conclusions.

If the results of long–short factor paper portfolios used in regression analysis to judge manager skill are not replicable with live assets, bad decisions may be made. We find that the performance of the market, value, and momentum factors in live portfolios is sharply lower than their performance in theoretical model portfolios.

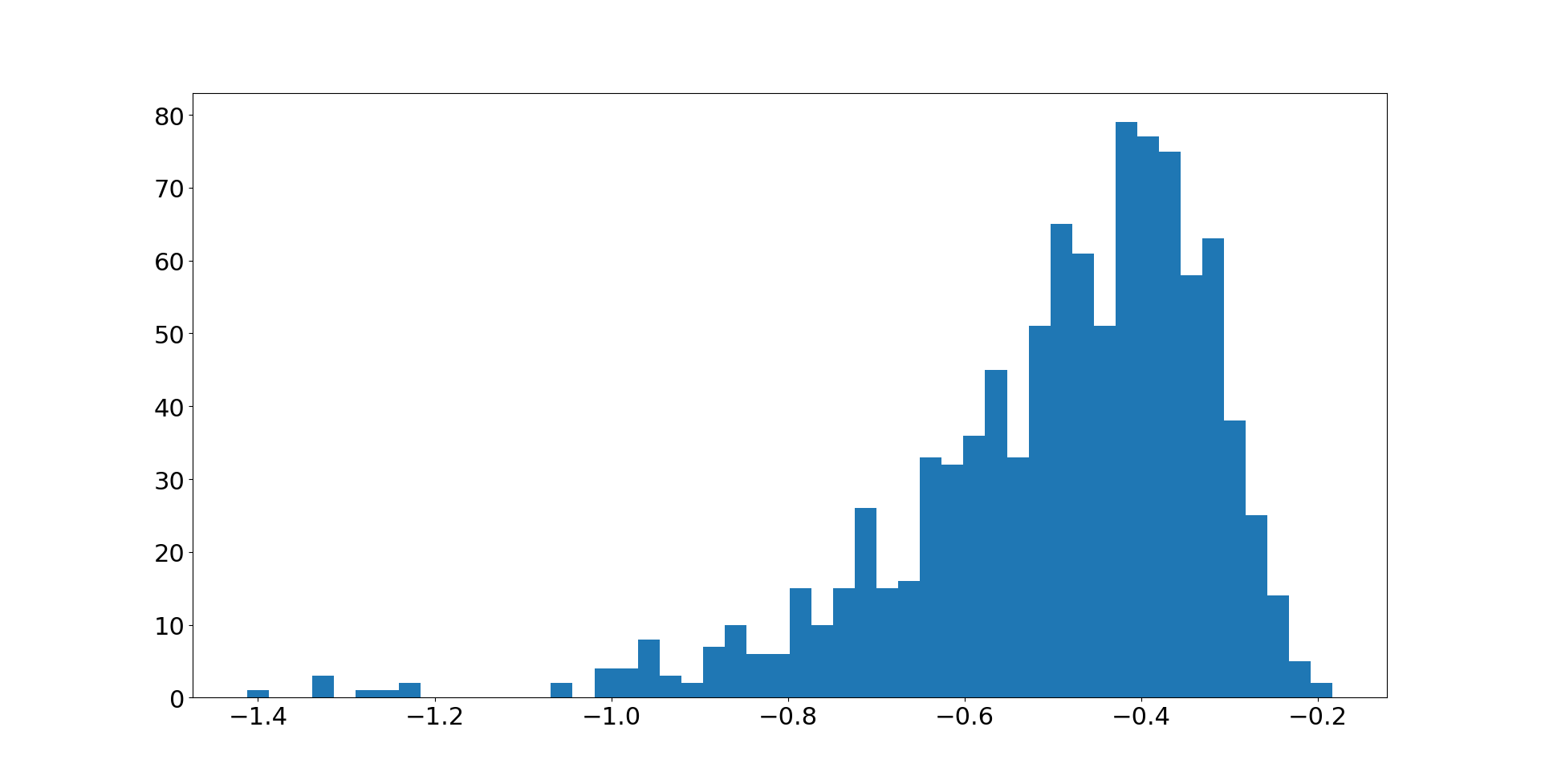

Maximum drawdown equal to relative drawdown series#

The first article of the series showed that the factor returns realized by mutual fund managers can be very different from the returns investors might expect based on the funds’ factor loadings. This article is the second in a series we are publishing in 2017.

0 kommentar(er)

0 kommentar(er)